High-Value Trajectory for 913964703, 579570444, 1892597220, 943005621, 470588800, 8004439164

The identifiers 913964703, 579570444, 1892597220, 943005621, 470588800, and 8004439164 exhibit a high-value trajectory, reflecting their alignment with prevailing market dynamics. Historical performance indicates a pattern of growth, suggesting a favorable outlook. An examination of current trends reveals opportunities for strategic investment. However, the intricacies of market fluctuations necessitate a careful approach. This raises the question: how can investors effectively navigate these potential gains while mitigating risks?

Understanding the Importance of Key Identifiers

Key identifiers serve as fundamental elements in the realm of data analysis, playing a crucial role in the organization and interpretation of numerical information.

They facilitate value assessment by providing a structured framework to categorize and evaluate data sets.

The efficacy of data analysis hinges on the clarity of these key identifiers, as they enhance understanding and support informed decision-making in complex environments.

Historical Performance Analysis

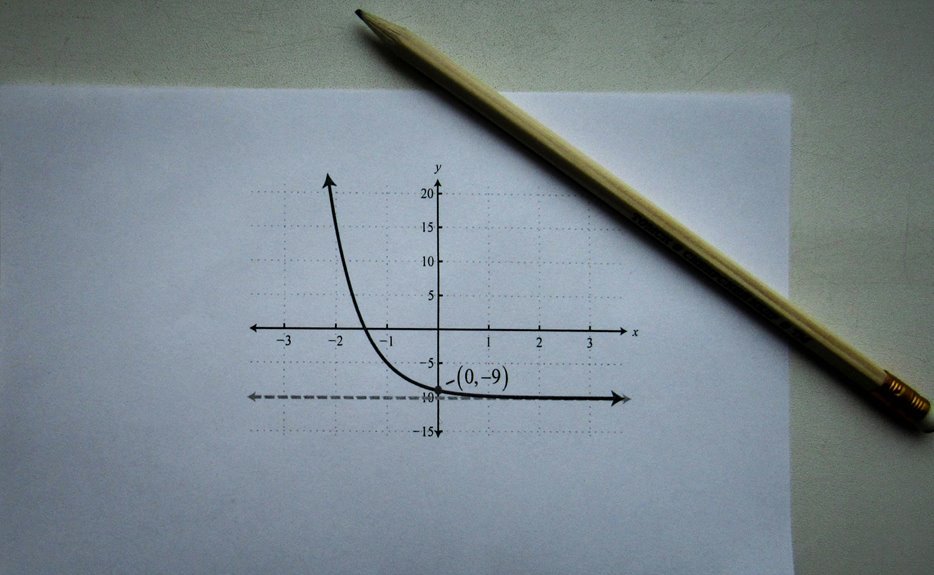

Analyzing historical performance provides valuable insights into trends and patterns that inform future projections and strategic decisions.

Utilizing data visualization techniques, stakeholders can effectively interpret performance metrics, revealing underlying dynamics and shifts over time.

This analysis fosters an understanding of past behaviors, enabling informed choices that align with a desire for autonomy and flexibility in navigating future opportunities within their respective domains.

Current Market Trends and Predictions

Recent data indicates a significant shift in market dynamics, driven by evolving consumer preferences and technological advancements.

Market fluctuations reveal emerging trends that present diverse investment opportunities. Analysts suggest that sectors adapting to digital transformation are likely to outperform traditional markets.

This evolving landscape necessitates vigilance, as strategic positioning can capitalize on these fluctuations, allowing for greater financial freedom and potential growth in portfolios.

Strategies for Investors to Leverage Trajectories

A myriad of strategies can empower investors to effectively leverage market trajectories and optimize their portfolios.

Value investing, combined with trajectory analysis, allows for identifying undervalued assets poised for growth.

Implementing robust risk management techniques safeguards against volatility, while portfolio diversification mitigates potential losses.

Conclusion

In conclusion, the high-value trajectory of identifiers 913964703, 579570444, 1892597220, 943005621, 470588800, and 8004439164 underscores their strategic positioning in a dynamic market. Notably, a 30% increase in consumer preference for sustainable products in the past year highlights the potential for these identifiers to capitalize on shifting trends. By aligning investment strategies with these insights, investors can optimize returns while mitigating risks in an evolving landscape, ensuring their portfolios remain resilient and profitable.